So, it's that time of year again. I have been a tax preparer since 1983. Licensed with the IRS as an Enrolled Agent since 1995. A few years ago I prepared close to 1500 tax returns a year, plus business taxes. Now I am semi-retired and I do only a few hundred returns. Some I do at home for friends and family, and I also work part-time at another tax office.

I don't miss the long hours (8am to midnite-5 days a week, plus 6-8 hrs on Saturday and the occasional Sunday). These long hours were for only 4 months of the year, but totalled almost as many hours as someone working 40 hours a week for 48 weeks.

I don't do any business taxes now. Small Businesses need to have their accountant available all year round, and I don't want to do that. I only work on Individual Tax Returns. I still enjoy tax preparation work and have a hard time stopping completely. Even though I get totally frustrated with the changes that Congress makes, I still like to help people save money by finding deductions they were not aware of.

I'm thinking that this job is pretty portable, and that I should be able to make some extra money every year doing tax returns no matter where I am.

Many of my tax clients would mail their returns to me after they moved out of Illinois.

Do you have your tax returns prepared in the area you are traveling or do you send them back to the tax preparer you had when you owned a house?

Remember that when you leave this Earth, you can take with you nothing that you have received, only what you have given, a full heart enriched by honest service, love, sacrifice and courage. -St. Francis of Assisi

Tuesday, February 15, 2011

Subscribe to:

Post Comments (Atom)

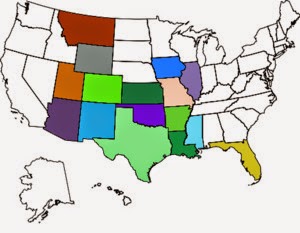

Overnight stays in these states:

It is the sandstorm that shape the stone statues of the Desert. It is the struggles of Life that form a person's character ~ Native American Proverb

As you know, we're not fulltimers yet. :) But I think I can answer your question anyway as far as what we will do with our taxes. We use one of the tax prep software programs now to do our taxes, and I imagine we will continue to do the same after we hit the road.

ReplyDeleteWe send ours back to a gal in Maryland that has done our taxes for several years now. For as long as I can remember, I did my own taxes. In 2005 I gave it up...have let a preparer do it since. Losing hubby brought a loss of focus on a lot of things, that was one of them. Now it's hard enough to gather everything together to send off to her. LOL!

ReplyDeleteSo ... Can we ask you tax questions? :~) :~)

ReplyDeleteMy husband has always done ours. I am an artist and he does contract so we are both self employed. Somehow my income always gets wiped out by deductions, but then it is below poverty level anyway!

I have been struggling with Goodwill donations since i did so many last year and will do a lot more this year as we empty the house in preparation for full timing.

I don't mind answering general tax questions. In order to give more specific answers I would need a ton of info from you. When I prepare a tax return, I ask a bunch of questions.

ReplyDeleteYou can email me tls2100 at yahoo dot com